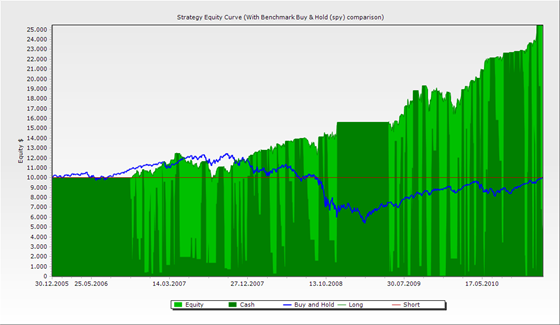

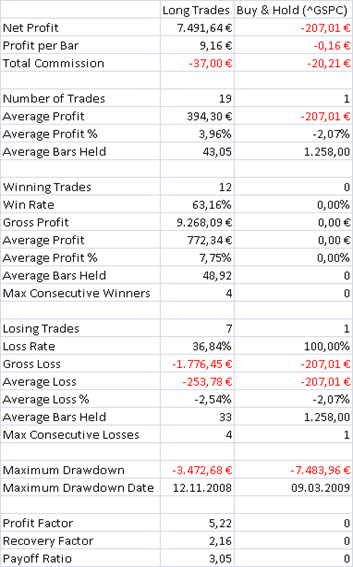

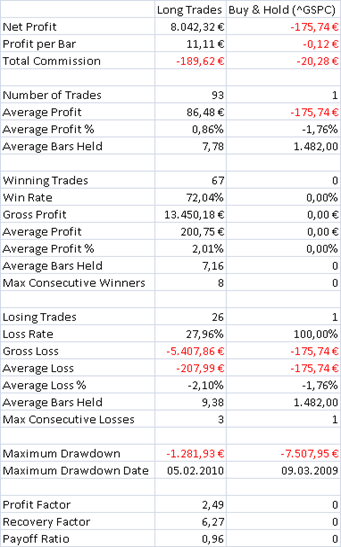

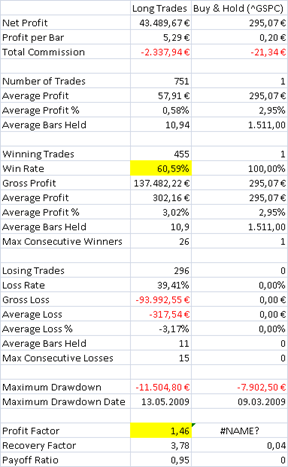

time period is 22.12.2005 - 22.12.2010

gold etf basket AU CEF DGL GDX GFI GLD HMY IAU KGC

Money management:

Number of shares to buy is determined by the follown formula. 20% of initial position divided by (Close-2 time 13 period ATR). Start allocate capital from those ETFs which have highest Close/200daySMA ratio.

Long:

- Take only long trades

- 2 period RSI is less than 30

- today is spy’s close is 1% above its 200 day SMA

- today is lowest low of the past 7 days

Exit Long

- method 1 : if 13 period adx is less than 30 and dmplus is higher than dminus and today is highest high of last 7 days

- method 2 : 13 period adx is greater than 30 and close > (13day ema + 2*atr13) and dmplus is higher than dminus