this indicator shows percent distance of close price from the moving averages.

Monday, December 7, 2009

Saturday, September 26, 2009

Mass Psychology

- Le Bon, Gustave. The Crowd: A Study of the Popular Mind

http://etext.virginia.edu/toc/modeng/public/BonCrow.html - In Propaganda (1928), his most important book, Bernays argued that the manipulation of public opinion was a necessary part of democracy. http://www.historyisaweapon.org/defcon1/bernprop.html

German

- Psychologie der Massen, http://www.textlog.de/le-bon-psychologie.html

- http://www.mehr-freiheit.de/idee/lebon.html

Monday, September 14, 2009

on risk management

Saturday, August 29, 2009

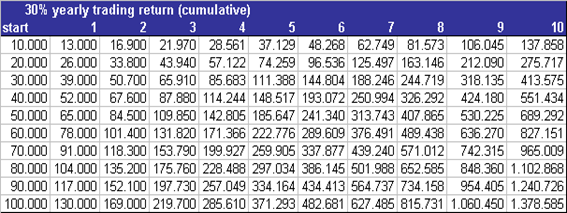

What can you earn with trading? starting capital for trading

I prepared two tables to show what can be earned from trading. First table below shows a trading return with %30 (2.5% monthly return of total equity) annul return which is very very good and reasonable. Second table below shows monthly constant net income (after expenses) such as your salary. when you compare starting capital with equal starting income rows you will see that trading will not generate much income.

for more information about this research please contact me from korayguclu [at] gmail [.] com

Friday, August 14, 2009

GETTING RICH

Human nature always wants more. How do you know when you are rich? How do you determine wealth. Robert K. has a simple answer to this question.

“if you stopped working today, how many days forward could you survive at your current standard of living?”

If you stop working today and can survice 30 years you have 30 years wealth.

DAILY MENTAL REHEARSAL

1. In the morning ask yourself some questions like "What could go wrong today that I’m not prepared for?" If you come up with some potential problems, then you need to come up with some solutions and rehearse them in your mind.

2. At the end of the day you need to ask yourself, "Did I make any mistakes today?" Where a mistake has to do with not following your rules.) And if you have no rules, then everything you do is a mistake. If no mistakes were made, pat yourself on the back. However, if you did make a mistake, then plan and rehearse how you will avoid that mistake in the future.

Ref: http://www.iitm.com/Weekly_update/Weekly%2052%20Feb%2013%202002.htm

Tuesday, August 11, 2009

NINJATRADER DEBUGGING with visual studio express edition

Visual Studio Express edition is free but It is not possible to attach to a process in Visual Studio Express edition. But there is a way to debug your ninjatrader scripts with express edition.

thx to this post: http://www.ninjatrader-support2.com/vb/showthread.php?t=15671 and http://stewartr.blogspot.com/2006/09...al-studio.html

STEPS

Open Visual Studio.

Create new console application project e.g. NinjaTraderDebug.

Save the project and close visual studio.

Go to the project directory and open with notepad the NinjaTraderDebug.csproj.user file.

Edit it to look like this (the bold lines is what I added, of course you need to put your path to NinjaTrader.exe).

<Project xmlns="http://schemas.microsoft.com/developer/msbuild/2003">

<PropertyGroup>

<StartAction>Program</StartAction>

<StartProgram>C:\Programme\NinjaTrader 6.5\bin\NinjaTrader.exe</StartProgram>

</PropertyGroup>

</Project>

Close NinjaTrader if it is opened.

Open the ninjatraderDebug project in VisualStudio.

Hit "Play" (F5), this will launch NinjaTrader and will attach to it.

Now do sections 1 and 3 from here: http://www.ninjatrader-support.com/H...l?VisualStudio

Tuesday, July 28, 2009

Four dimensions of technical analysis.

Source: The Three Skills of top trading, p.59

A technical analyst can groups his analysis in four dimensions as

- price studies

- volume studies(on balance volume)

- time studies (cycles etc.. )

- sentiment/breadth studies (52 weeks nhnl index, upside volume downside volume, advances declines etc..).

those four groups will add different dimensions to your analysis. Do not only simply select a dozen of indicators in one group. Simple is better select one indicator in each group. so that you can track different dimensions of the market.

Saturday, June 13, 2009

Wednesday, June 3, 2009

Saturday, May 9, 2009

about libor rates

Gold is rising rising gold is a good sing. Gold leads the market by many months. Stock markets is building a bottom. This is conforming what gold libor and bonds are saying.

Market is deeply oversold.

News are lagging indicators do not watch the news!!

If you already hold stocks since 1 year do not sell your stocks. You will be selling them at the bottom!

Illistrations: © Mary Anne Aden, and fed

Sunday, May 3, 2009

RSI Index versus macd lines

RSI index and MAD FAst line is highly correlated. Therefore, it do not add any value to use both at the same time! Simple methods work better!.

Friday, May 1, 2009

ORDER TYPES

stop limit: long trade icin verilen stop degeri asilinca limit order i markete gönder. burada stop>limit olmasi lazim aksi taktirder anlam ifadece etmiyor. shor trade icinde bunun tersi dogrudur.

auto trailing stop order: limit order i verdikten sonra trailing stop order i attach yapiyorsun. stop order yukari dogru kaymaya basliyor fiyat ile birlikte. bu order kari korumak icin cok yararli bir order.

Sunday, April 26, 2009

Friday, April 24, 2009

FREE TRADING VIDEOS

- Dr. Elder’s stock trading video https://admin.na3.acrobat.com/_a790374099/p16612275/

- Martin Pring’s intermarket model http://www.pring.com/movieweb/imrcommercial/imrcommercial.html

Monday, April 20, 2009

Short PiCKS

DBK

ARL

NDX1-Xet

Asian markets are negative this morning which is confirming our short picks. but market is very confusing at the moment do not immediate trade those picks.

Saturday, April 18, 2009

Wyckoff method – Price and volume relationships

Each day, the 1) price of the market or an issue is likely to move up or down on a close to close

basis. It does so either in a 2) price spread that is likely to be wider or narrower than the day before

and 3) volume that is likely to be either higher or lower than the day before. How these three

variables group themselves together determines that character of the action for that day and

whether it makes a bullish or bearish statement.

UPSIDE

If the price spread for a day is wider to the up side leading to a strong close on increased volume,

the advance is said to indicate demand entering. This action makes a bullish statement. If the

same price action occurs on reduced volume, the advance is said to be the result of a lack of

supply. This action also makes a bullish statement.

<=>

If the price spread for a day is narrower to the upside, the action makes a bearish statement. If the narrower spread to the up side is combined with higher volume, the action is said to indicate the meeting of supply. If the volume is reduced,the action is said to indicate a lack of demand. Either combination tends to work against additional up side progress. That is why the statements made are considered to be bearish.

DOWNSIDE

If the price spread for a day is wider to the down side leading to a poor close on increased

volume, the decline is said to indicate supply entering. This action makes a bearish statement.

The same price action on decreased volume is said to be the result of a lack of demand. It also

makes a bearish statement.

<=>

If the price spread for a day is narrower to the down side, it makes a

bullish statement. If the narrower spread is combined with high volume, the action is said to

indicate the meeting of demand. If the volume is lower, it is said to indicate a lack of supply.

Either combination tends to work against additional down side progress. That is why it makes a

bearish statement.

POOR CLOSES

Sometimes there are days that start out as wide spreads to the up side, but end with poor closes.

There can also be days that start out as wide spreads to the down side, but end up with strong

closes. These days are said to include intra-day failures. These failures change the character of

the action from what it might seem to be on the surface. A wider spread to the up side on

increased volume makes a bullish statement because it indicates demand entering if the close is

strong. However, if the close is poor, the indication is that the demand that was present initially

was either withdrawn or overwhelmed by supply. In both cases,the intra-day failure changes the

bullish statement to a bearish statement. However, being overwhelmed by supply is considered

to be more bearish than is having demand withdrawn. Intra-day failures that occur to the down

side on wide spreads and high volumes leading to strong closes change what would otherwise be

bearish statements into bullish statements. In these cases, the indication is that either the supply

was withdrawn or that supply was overwhelmed by demand. Demand overwhelming supply is

said to be more bullish than having supply withdrawn. Trying to interpret the exact meaning of

an intra-day failure can sometime be difficult if the action of the day is only looked at as a

whole. Viewing the intra-day action can assist in determining where the bulk of the volume was

present and that can help with the interpretation

Resource: http://www.wyckoffstockmarketinstitute.com/Archives/Price_Volume_Relationships.pdf

Articles

- It is important to have a Trading plan

- Gaps gives clues about the direction of the trend

- Simple things work better. 1 point rule is very simple. You can combine 1 point rule to with wyckoff method

- Importance of having structure in your trading

- You need to analyse long term movements short term movements of markets and analyse the intermarket analysis to be a successful trader.

- Trading Psychology versus Trading Method

- The Trading Psychology Plan versus Trading plan

- Trading Psychology -- Consecutive Losses and the Trading Psychology

- The key to trading profitably has nothing to do with technical theory. It has to do with detecting when the buyers or sellers are going to have to take evasive action.

- Paper trading is the first step in improving your trading methods. You need to later improve your trading psychology skills by trading actively and taking low risks.

- Behavioral Patterns That Sabotage Traders part 1, part 2

- wyckoff and volume

- Using Protective Stop Orders To Your Advantage

- Risk Management Notes (time, duration, frequency)

- Chandlier exist part 1, part 2

- Tunnle vision part 1, part 2

- companing technical analysis and fundamentals ETF example

- Dealing with Stress for Trading Success

- Trade psychology,The Sentiment Cycle

- there is only one side to the stock market; and it is not the bull side or the bear side, but the right side.

- The principles of successful stock speculation are based on the supposition that people will continue in the future to make the mistakes that they have made in the past.

- The 22 rules of trading

- interest rate effect

- Trading plan

Wednesday, April 8, 2009

Sunday, March 29, 2009

20090329 Market Analysis

ALMANYA NH-NL INDEXSI

Haftalik NH-NL indexi divergence göstermis. bu bullish demek uzun dönemde.

Günlük NH-NL indexine bakildiginda index degeri isaretlenen yerlerde simdi oldugu duruma gelmis. bunun yaninda günlük asagi trend cizgisinin oldugu yere gelmis.

Buna göre ve bir önce gönderdigim amerikan index analizine göre pazartesi indexler düsecek.

SHORT ICIN PICKLER

indexler düsecegine göre asagida short yapmak icin indexlerden ilk basta eleme yaparak en kotu sektörü Conglomar. olarak buldum. Congloma. Sektörü en cok yukselen ve sonra en cok düsen sektörler arasindan.

BEAR MARKETLER ARASINDAKI BENZERLIKLER

Bu benzerlik grafigine göre marketlerin daha düsmesi muhtemel.(Bu karsilastirmalar arasinda farkliliklar var. Farkli kisiler arastirmayi yapmis.)

Saturday, March 28, 2009

2009.03.28 – Marketler / BEARISH

Günlük grafikte direnc noktalari

QQQQ

SPY

DIA

5 günlük intraday grafikler

DIA

SPY

QQQQ

günlük grafiklerde indexler yukari dogru cikarken önceki direnc seviylerini kirmis. Bu direnc seviyeleri kirildiktan sonra indexler en cok islem hacminin oldugu noktada kalmis. Cuma günü negativ kapandi yukaridaki indexler.